Editor’s note: At AGC Houston’s 2014 Annual Chapter Meeting which was held in January, one of the featured guest speakers was Patrick Jankowski, Regional Economist and Vice President of Research for the Greater Houston Partnership (GHP). Following Ken Simonson’s presentation about the outlook for construction, Jankowski offered the following presentation about the Houston economy in general, which is published here with permission.

Editor’s note: At AGC Houston’s 2014 Annual Chapter Meeting which was held in January, one of the featured guest speakers was Patrick Jankowski, Regional Economist and Vice President of Research for the Greater Houston Partnership (GHP). Following Ken Simonson’s presentation about the outlook for construction, Jankowski offered the following presentation about the Houston economy in general, which is published here with permission.

I'm going to give you an outlook of what we see going on in the Houston economy in general. In 2014, Houston is going to enter the "New Normal."

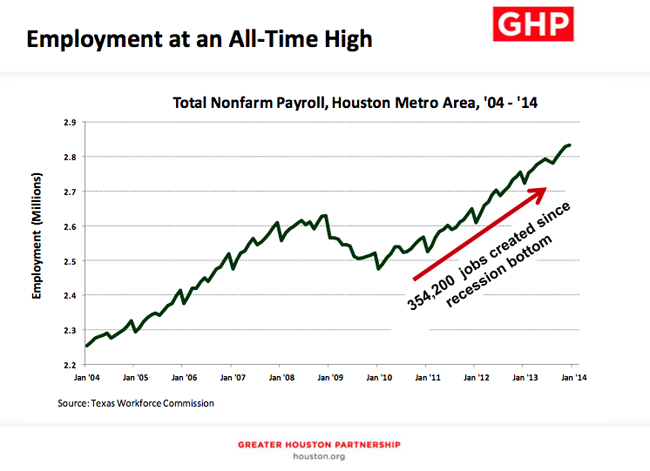

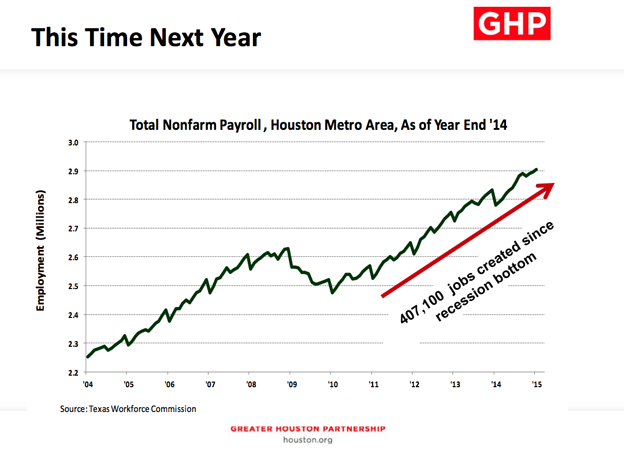

The chart below shows nonfarm payroll employment. This is what employment has done going back to January 2004. You see the peak that we reached in 2008, right around the time Hurricane Katrina hit. You can see the dip - the bottom of the recession for us is January 2010.

You can see the recovery - 354,200 jobs have been added into this economy since the bottom of the recession. This is a phenomenal number. The point at the far end is the highest point on the line, meaning there are more people working in Houston now than have ever worked in Houston before. We are in an all time employment high.

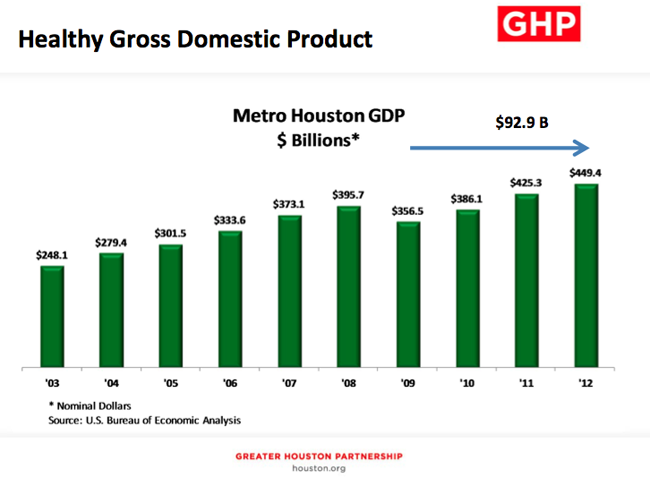

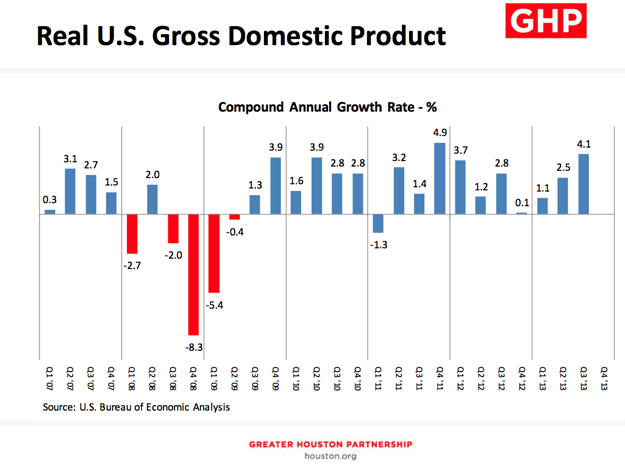

The next chart (shown above) shows what's happening with Gross Domestic Product, the source is the Bureau of Economic Analysis. You can see our recession year was really 2009. That was the year in which we really struggled. You can see the growth in general economic activity, growth and Gross Domestic Product, which has occurred over the past years. Our GDP, our regional economy, is actually $92 billion larger now that it was at the bottom of the recession. You can see our previous peak in 2008, which was a pretty good year. We are $50 billion larger than we were at our previous peak.

Houston's economy is the second fastest growing economy, growing at a 5.3% annual rate. San Francisco is growing a little bit faster than us. San Francisco is being driven by technology, while Houston is being driven by oil and gas and international trade. A year ago, Houston was above San Francisco. This list is of the twenty most populous metropolitan areas. Houston's 5.3% growth rate is really pretty strong, especially if you look at what's happening with the U.S. GDP. The U.S. GDP has been struggling to break 3% on a regular basis.

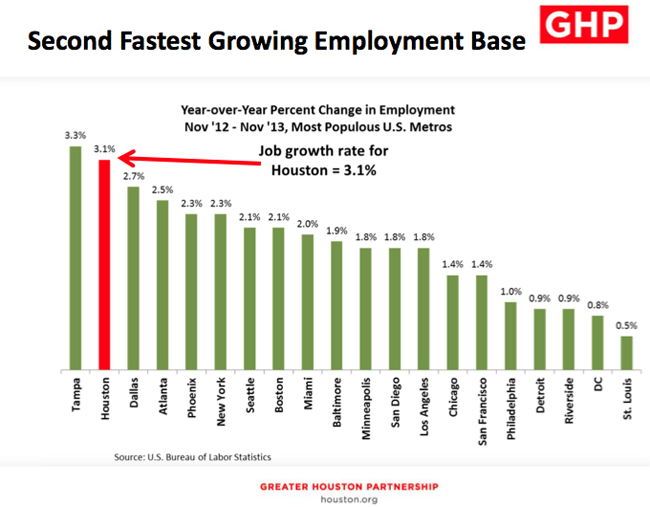

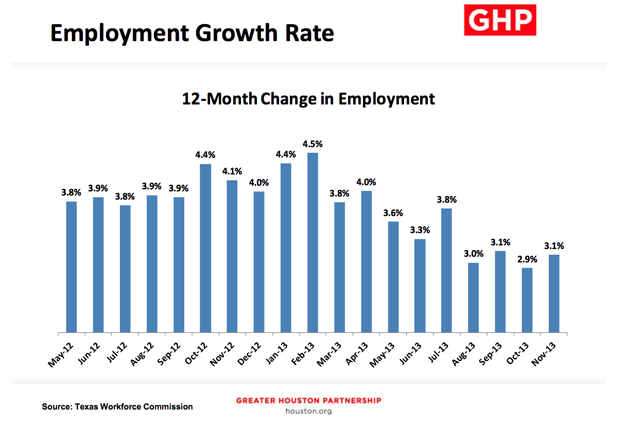

If you look at employment growth, at 3.1%, we have the second fastest growing nonfarm payroll employment, the second fastest growing job base. Tampa is running a little bit faster than Houston, but that's a fairly recent phenomenon. Tampa is also growing off a much smaller base. It's easy to have a high percentage growth rate when you're growing off a smaller base, but this 3.1% is really fairly healthy and fairly strong, especially when you look at what's going on at all of the other major metropolitan areas. Houston has the second fastest employment growth, and Dallas has the third fastest.

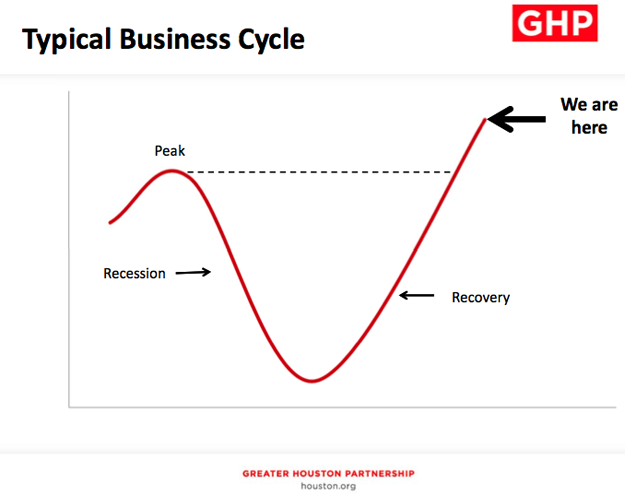

If you go back to your basic Economics 101 or basic business class, the typical business cycle: we can see the peak, the decline during the recession, the trough, and the recovery. On the chart above, you can see where we are. We are above our previous peak. We have a large economy with more people working and in general more business activity.

When you look at a chart like this, at some point the line on the righthand side is going to start to bend. So the question is when does that line start to bend in the business cycle? Well, I need to let you know, it already has. We're already starting to see a bit of a slowdown in the economy.

This is the change in payroll employment, so you can look in May of 2012, employment was growing at a 3.8% annual rate. We had an extremely hot economy in late 2012, early 2013, with February having a 4.5% annual growth rate in employment, which is just phenomenal. You can see it trending down now. Although at 3.1%, which is a little bit trending down, it's still the second fastest employment growth in the United States right now among the major metropolitan areas.

So what's causing the bend?

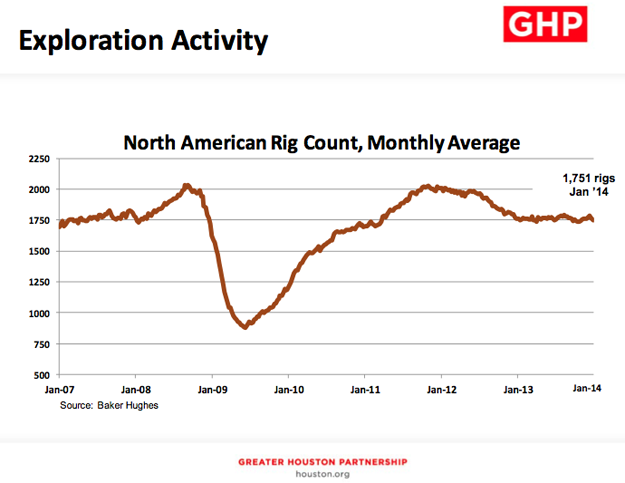

There are a few things that you need to be aware of. For one thing, the rig count is flat. It's flat because we've become very efficient at what we're doing. Oil and gas drives an awful lot of this economy.

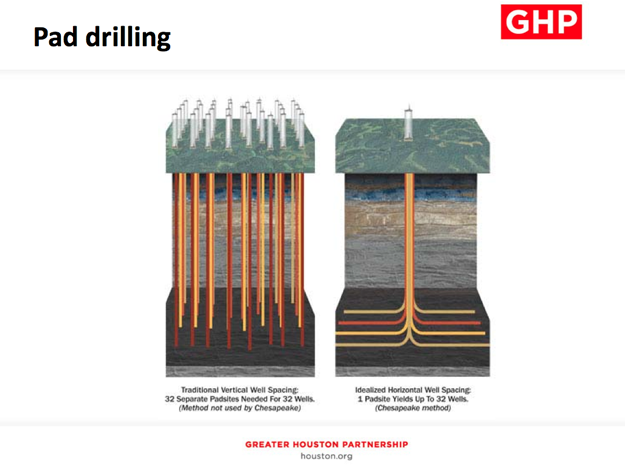

It's flat also because of a new phenomenon called pad drilling. Collin Eaton at the Houston Chronicle has been writing about this. In the old days, if you were going to drill wells, you would drill one well straight down, hope you hit the sweet spot, and then start producing. Now with directional drilling, and with pad drilling, you can set a rig up on one site, drill down, turn sideways, turn left, turn right, and drill multiple wells. You're getting five or six wells being drilled off one pad site. There are actually rigs out there now that when they finish drilling the well, they flip a switch, and the rig literally "walks" another 100 feet and stops, and they start drilling again in another direction. So you can see how much more efficient that is. It takes less time to transport, less time to set up, less time to take down, and that's one of the reasons why the rig count is flat.

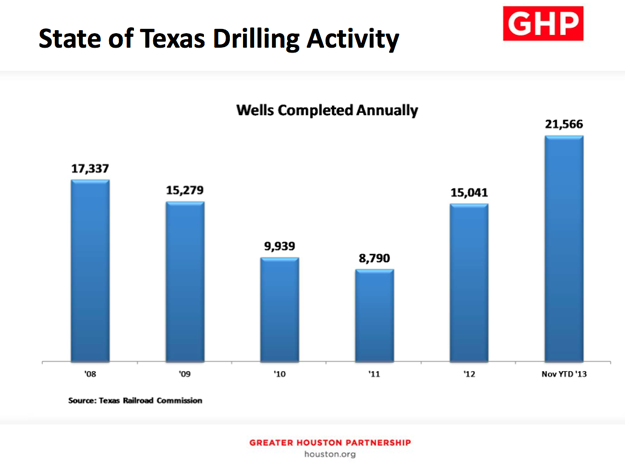

However, even with the rig count flattening, we're actually drilling more wells. We're drilling more wells with fewer rigs. Through November this past year, 21,000 wells were drilled, which was 6,000 more than the prior year.

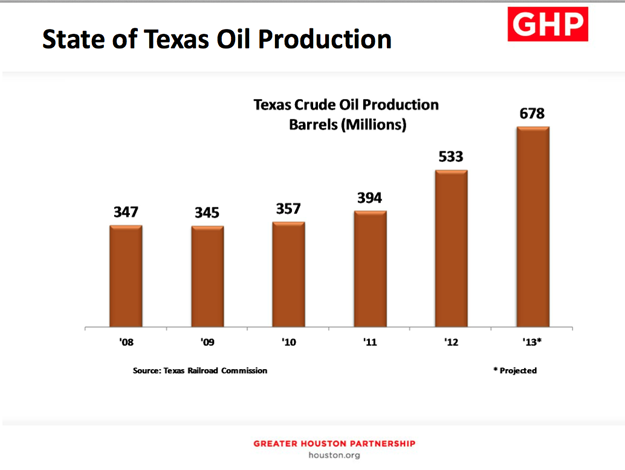

Production is also going up. So even with fewer rigs, with this pad drilling, the fact that we got so efficient at what we're doing, production is going up. This is not going to affect the exploration or production people who work in the office, but it is having an impact on those who manufacture the oilfield equipment because you need fewer rigs to produce more oil. It's also having an effect on the people who work in the field actually drilling for oil because the same crew controls multiple wells. So, we are seeing a slowdown there, and that is one thing that is affecting the economy somewhat.

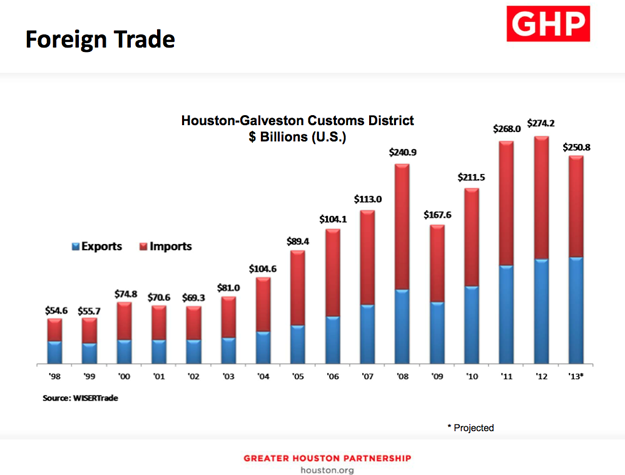

The other thing that is affecting the economy is foreign trade. We've had an incredible amount of growth in foreign trade over the last fifteen years. This is through the customs district. The port of Houston is a great port, and we also have a port in Galveston, we have a port in Texas City, we have a port in Freeport, and there is an airport north of town. You can see the phenomenal growth Houston has had. If you look at the projected growth for 2013, the red is imports, the blue is exports, you can see it falling off. The red is not a concern. The red is imports, and the main part of the fall-off there is the fact that we're importing a lot less oil. We're importing less oil because of what is going on in the Eagle Ford, Bakken, and Niobrara shale formations. One thing that is concerning is that we're seeing a little bit of a leveling off in exports. It's still an extremely healthy level, and if you look at the International Trade Administration, when they published their data last year, Houston was the number one metropolitan area for exports in the U.S. So we still hold a number one position, but we're seeing a little bit of a slowing there.

One thing that we'd like to see is a stronger growth in U.S. GDP. Three things drive Houston's economy: one is international trade, one is oil and gas, and the other is U.S. GDP. We're only now starting to see some improvement in U.S. GDP, and if we see the U.S. GDP continue to grow, maybe not at 4%, but if it grows at 3%, we won't notice much of a slowdown in Houston, but we are going to see a little bit of a slowdown, and we're going to see the line bend. However, this bend that we're seeing is not bad news. What that bend suggests is that Houston is finally returning to "normal", and we're finally returning to sustainable growth because what we've had over the last five years has not been normal, nor has it been sustainable.

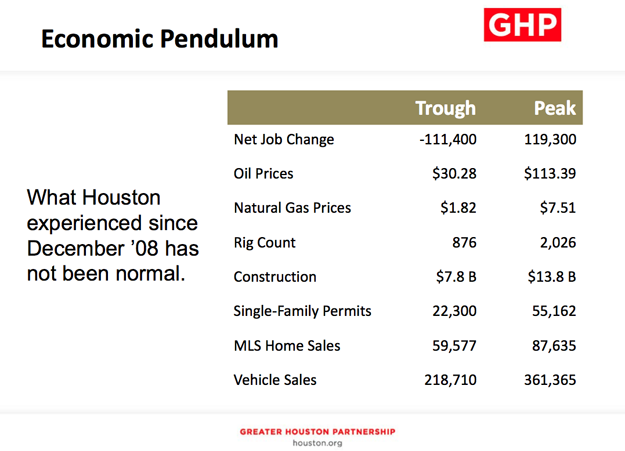

Above, I put together a few data points, and over the last five years we've hit both the trough and peak. At one time we were losing jobs at the rate of 111,000 jobs a year, and then another time we were adding jobs at almost a rate of 120,000 a year. Natural gas prices fell below $2 in Mcf and then they were up to $7.51. One time we were building only 22,000 single-family homes, and then we were building 55,000. Another way this information can be labeled is that the left side is labeled "not normal" instead of "trough" and the right side is labeled "not sustainable" instead of "peak." What we're seeing Houston enter into is a long-term period of normal sustainable growth. It's going to be a little slower than we experienced in the last two years, and that's not necessarily a bad thing. Normal and sustainable is what we want.

Normal and sustainable growth will be supported by oil that stays above $70 a barrel, a 6:1 ratio of oil to natural gas, which means it's cheaper to manufacture chemicals in the U.S., a regional population growth of 125,000 people a year, affordable living, and work ethic.

A measure of work ethic may sound kind of fuzzy, but there is a professor at Rice University, Stephen Klineberg, who has done a survey for the last thirty years. He does it every March, and he calls people who live in the region, and asks them a series of questions. One of the questions Klineberg asks is, "Do you agree or disagree with this statement: If I work hard in this city, I will eventually succeed." 89% of the people who are asked, agree, which means that people in Houston believe that hard work pays off. One of the things that's going to continue to drive our economy is the work ethic we have here. If you look at a similar question on a Gallup poll nationwide, it comes in below 50%, which is really kind of scary for the nation as a whole.

Let's get more into the Greater Houston Partnership's forecast. We're forecasting 69,800 new jobs this year. That's a 2.5% annual growth rate. The longterm average in Houston is about 2.2%, so we're still above trend. We're going to see job creation in every sector.

So this time next year, there will have been 407,100 jobs created since the bottom of the recession. Think about that: over 400,000 jobs since the bottom of our recession. We're going to see job creation in every sector, and the job creation is going to be above trend.

I tell people "normal" is not just a setting on the dryer cycle. Normal is what we're expecting in Houston, and normal is what we desire in Houston. What would normal look like for this year? Normal would look like 125,000 new residents per year, about 65,000 new jobs per year, 30,000 single family and 12,000 multi-family housing starts, $250,000 billion in foreign trade pass through our ports each year, and about 50 million passengers going through our airports each year. Fifty million passengers a year is like taking one out of every six persons who live in the United States, and pushing them through our airport system. So that's what a normal year would look like.

Some people are disappointed about normal, but if normal is all we have to look forward to from this point out, five years from now there will be another 625,000 residents living in Houston, another 325,000 people working here, 150,000 new single family homes, 60,000 fresh apartment units, $1.2 trillion in foreign trade will have passed through this region, and 250 million air passengers will have passed through this region over the next five years. From a forecaster's perspective, normal looks pretty good.

Add new comment