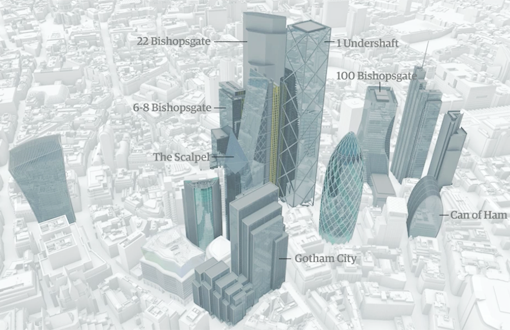

It was noted just the other day in The Guardian that in London, home to many major multinationals and a key player in the European Union, there are 436 planned buildings that will be over 20 stories tall. Eighty-nine are currently under construction and the 233 approved proposed buildings in the pipeline have more than doubled in the last year.

It was noted just the other day in The Guardian that in London, home to many major multinationals and a key player in the European Union, there are 436 planned buildings that will be over 20 stories tall. Eighty-nine are currently under construction and the 233 approved proposed buildings in the pipeline have more than doubled in the last year.

In the overall London approval process that is similarly economically driven like Houston, but still at least 10 times tougher, only 3 buildings have been denied approval for construction. There are on-going debates about the clustering of the towers, sight lines to St. Paul’s Cathedral, shadow patterns on nearby buildings, and wind tunnels created by the buildings. However, once a building has been approved, its development is dependent on the financing of the scheme.

That number is astonishing to me. That is 436 new buildings that will be added to the existing skyline. Sure, a number of them are either residential or mixed use, and the majority of them are office buildings; but it appears that the demand for the space is there waiting for the supply to catch up. I was reminded of a similar growth spurt in Houston.

In 1982, developers in Houston, Texas completed office towers that, in one year, doubled the amount of available office space. What followed was over two decades of lease up time for those projects with few new buildings over 20 stories built in the marketplace.

Today, there are 360 buildings in Houston that, according to the Council on Tall Buildings and Urban Habitat, are over 20 stories tall. In the last 5 years, there has been an additional growth spurt during the oil and gas run up to $100 per barrel. Now the price has dropped to a new low of $30 per barrel and vacancies are rising.

With the slump of the energy business, oil is now available at what one source said was “cheaper than the cost of the barrel to store it in.” This glut of petrochemical products, the construction of new campuses for Exxon, and the resultant mergers and bankruptcies, has created over 10 million square feet of sublease office space in the market in Houston. It's not 1983, but troubling just as well.

In reading the Guardian articles on architecture, it is my hope that the development and design communities pay attention to the lessons learned in Houston and that they do not make the same mistakes that we made over again.