Fewer metros add construction jobs in October; Dodge, Beige Book report mixed starts Editor’s note: Construction Citizen is proud to partner with AGC America to bring you AGC Chief Economist Ken Simonson's Data DIGest. Check back each week to get Ken's expert analysis of what's happening in our industry.

Editor’s note: Construction Citizen is proud to partner with AGC America to bring you AGC Chief Economist Ken Simonson's Data DIGest. Check back each week to get Ken's expert analysis of what's happening in our industry.

Help AGC generate a comprehensive construction business outlook for 2017 by taking their 2017 Construction Industry Hiring and Business Outlook survey.

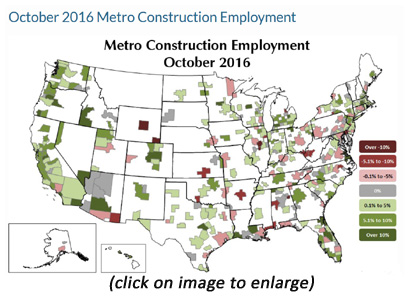

Construction employment, not seasonally adjusted, increased from October 2015 to October 2016 in 223 (62%) of the 358 metro areas (including divisions of larger metros) for which the Bureau of Labor Statistics (BLS) provides construction employment data, decreased in 73 (20%) and was stagnant in 62, according to an AGC release and map on Tuesday.(BLS combines mining and logging with construction in most metros.) Two metro areas tied for the most jobs added (10,800 combined jobs): Denver-Aurora-Lakewood (an 11% increase) and Orlando-Kissimmee-Sanford (17%); they were followed by Phoenix-Mesa-Scottsdale (9,900 construction jobs, 10%), the Anaheim-Santa Ana-Irvine, Calif. division (9,000 construction jobs, 10%) and Las-Vegas-Henderson-Paradise (8,500 construction jobs, 16%). The largest by Orlando-Kissimmee-Sanford and Las Vegas-Henderson-Paradise. The largest job losses occurred in Houston-The Woodlands-Sugar Land (-9,700 construction jobs, -4%); Baltimore-Columbia-Towson (-2,400 combined jobs, -3%); the Los Angeles-Long Beach-Glendale division (-2,100 construction jobs, -2%) and Little Rock-North Little Rock-Conway, Ark. (-1,800 combined jobs, -10%). The largest percentage decline was in Decatur, Ill. (-16%, -600 combined jobs), followed by Cheyenne, Wyo. (-13%, -500 combined jobs) and Bloomington, Ill. (-13%, -400 combined job). (Not-seasonally-adjusted data should not be compared to other months.)

The value of construction starts decreased 4% from September to October at a seasonally adjusted annual rate, Dodge Data & Analytics reported on November 22. "Nonresidential building retreated [-16%] from its brisk September pace, which was this sector's strongest volume so far in 2016. October's level for nonresidential building was still healthy compared to what's been reported for much of 2016—while down 12% from its average for August and September, it remained 15% above its lackluster average for this year's first seven months. Residential building in October showed moderate growth [6%], with contributions from both single-family and multifamily housing. Nonbuilding construction in October edged up slightly [1%], as an increase for public works offset diminished activity for electric utilities/gas plants....For the first ten months of 2016, total construction starts on an unadjusted basis were...down a slight 1% from the same period a year ago. If the volatile manufacturing plant and electric utility/gas plant categories are excluded, total construction starts during this year's January-October period would be up 3%." Chief economist Robert Murray noted that "'On balance, the current year is turning out to be one where the overall level of construction starts is at least holding steady...Supportive elements are moderate job growth, generally healthy market fundamentals for commercial real estate, and the funding coming from the state and local bond measures passed in recent years.'...Nonresidential building year-to-date matched the same period a year ago, with commercial building up 10%, institutional building even with last year, and manufacturing building down 36%. Residential building year-to-date rose 5%, with single-family housing up 7% and multifamily housing up 1%. Nonbuilding construction year-to-date fell 11%, with public works down 3% and electric utilities/gas plants down 28%."

“Reports from the 12 Federal Reserve Districts indicate that the economy continued to expand across most regions from early October through mid-November," the Fed reported yesterday in the latest "Beige Book" (named for the color of its cover), a compilation of informal soundings of firms in each district. The districts are referenced by their headquarters cities. "...several companies announc[ed] facility expansion plans in St. Louis and Minneapolis....Residential construction was up in the Cleveland, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City and Dallas districts....Commercial construction activity moved higher in the New York, Cleveland, Richmond, Atlanta, St. Louis, Kansas City and San Francisco districts. In contrast, Minneapolis noted a slowing in commercial construction. Ongoing multifamily construction has been steady at a fairly high level in New York. Multifamily construction varied in the Atlanta district and slowed somewhat in Richmond, Minneapolis and San Francisco....Contacts in Minneapolis and Atlanta reported expansion of renewable energy projects, particularly solar and wind....Contacts in the Philadelphia, Cleveland, Atlanta, St. Louis and Minneapolis districts reported increases in the cost of building materials.”

In line with the Beige Book reports on materials prices, New South Construction News reported on November 23, "As a result of their increased costs for raw materials, most manufacturers of steel construction products increased prices in November or have indicated they will raise prices in the near future. Prices for metal alloys such as copper and stainless steel have risen by as much as 20% since mid-October and manufacturers of construction materials made from these materials will increase prices as well....Domestic rebar mills unexpectedly implemented a $20/ton price increase on October 27 and 28 [and] again by $30/ton the second week in November....If the price for scrap steel increases in December, as most analysts expect, domestic mills will in all likelihood increase prices again in December. Domestic masonry reinforcing and tie manufacturers have also indicated they will increase prices in January due to their increased costs for wire rod and zinc. None have announced the effective date of their price increase or how much they will increase prices, however; manufacturers are expected to make a formal announcement by mid-December. Both Dow Building Solutions, a division of The Dow Chemical Company, and R Max announced a 5% price increase for their entire lines of polyisocyanurate insulations in December.”

The Data DIGest is a weekly summary of economic news; items most relevant to construction are in italics. All rights reserved. Sign up at www.agc.org/datadigest.

AGC's Data DIGest: November 22-30, 2016

by Ken Simonson | December 01, 2016