The following article originally appeared in the April newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

The following article originally appeared in the April newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

Stronger signals of the slowdown in Houston are increasingly prevalent. As the oil price bounces around the $50 mark, the effect of the lower cash flow in the oil and gas companies is rippling through the city.

The Architecture Billings Index, a national leading indicator for construction, is flat – which is indicative of the mentality of the market today. Pause. Wait and See. Everyone knows the tidal-wave impact of the oil and gas prices is coming, but no one can tell how damaging it will truly be. And while 2015 still looks to be a relatively strong year, 2016 has much less optimism.

The residential sector is slowing down – not because demand has weakened, but because builders are tentative about the months ahead. Similarly, multifamily is coming to a halt. The most at risk for overbuilding, over 50 commercial sites slated for multifamily are no longer under contract, according to CBRE. The office market is on hold, with 2 msf of sublease space having entered the market since the start of the year, and the industrial/warehouse market hasn’t seen the slowdown yet but is carefully watching to know when the tide will turn for them. Retail stands alone as the star market in the CBRE first quarter preview, as they tend to lag the other markets and have been the beneficiary of all the land that multifamily projects will no longer inhabit. Most projections are that the second half of 2015 is when the impact of oil prices will be truly felt through the construction industry.

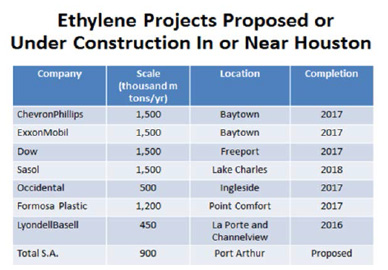

The amount of industrial work in the Houston area, however, will not be slowing for a few years. All the LNG and Ethylene projects in the area are continuing ahead. In the table above, you can see the number of Ethylene projects, each worth $5 Billion when combined with their associated plastics plants, which will be moving forward with the exception of the Port Arthur project. That project, along with all others that were looking at a later construction timeline (2018-2020) are now being postponed or cancelled. This bodes well for our market, because presumably, as those workers finish the projects in 2017, they will run out of work and return to the commercial market just as our market will hopefully be ramping up again.

It is not all doom and gloom for the commercial construction industry this year. However, the deceleration in the market will require companies to actively seek work rather than wait for their phones to ring.

Houston’s Monthly Metrics: April 2015

by Candace Hernandez | April 14, 2015