The following article originally appeared in the February newsletter to clients of Kiley Advisors, now a part of FMI Corporation, for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

The following article originally appeared in the February newsletter to clients of Kiley Advisors, now a part of FMI Corporation, for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

Houston managed to squeak through 2016 with a net job growth of 14,800 jobs. For what many economists have stated is the worst recession to hit Houston in decades, that is a major achievement for our region and a testament to the diversification of our city.

Thanks to our ever-growing Port of Houston and Texas Medical Center, and the heavy industrial boom on the east side of town, Houston was buffered from a more severe downturn. However, companies were also quicker to act. Right-sizing and making the difficult decisions early. Breaking the bone to ensure it resets itself right the first time.

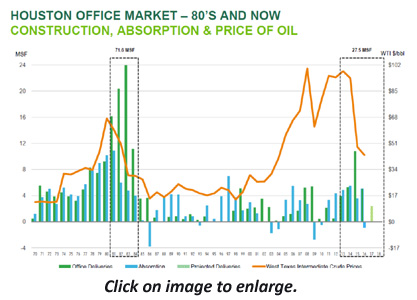

One example is the office market, which in 2014 was the national leader in office construction. As shown in the CBRE chart pictured here, the first block is the period 1981 - 1984, when 71.6 msf of office space was delivered as oil prices tumbled. Compare that to the most recent oil downturn where only 27.5 msf were delivered, and in a much larger market than Houston had 30 years ago. As of Q4 2016, Houston has 2.4 msf under construction and no projected deliveries beyond 2017. This will give our city time to absorb the office space currently vacant before the next construction cycle begins.

Light Industrial is another market that has done well in navigating the slowdown. They continue to post low vacancy rates and a declining construction pipeline, keeping the market tight and competitive, and not overbuilt. Houston's single family construction is currently second in the nation (behind Dallas) with a slightly stronger 2017 projected by Metrostudy as developers shift their products to cater to the homebuyers looking to spend under $325K.

However, not all segments were as quick to adjust course. The multifamily market continues to have an estimated 15,000 units under construction, 12,000 of which should be delivered in 2017. Patrick Jankowski, Vice President of Research at the Greater Houston Partnership, noted the old adage of six jobs for every one additional apartment unit needed, which means Houston would need 90,000 in job growth to cover what is currently under construction (and does not include the nearly 24,000 units that are finished, vacant, and in lease-up).

Houston’s Monthly Metrics: February 2017

by Candace Hernandez | February 10, 2017