The following article originally appeared in the July newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

The following article originally appeared in the July newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

The construction market continues to be on fire. CBRE’s early preview of the second quarter shows all sectors are still busy. Office absorption and asking rates are up quarter over quarter. It is the same story in light industrial and retail with the latter reportedly having 2.7 msf under construction in the second quarter.

Multi-family has 25,000 units under construction in the greater Houston area. The rising rates in apartments have two primary drivers. The first is the dramatic increase in housing costs (17% increase in the median home price year over year) caused by the limited supply of homes to meet the much-greater demand. This trend is expected to continue for the next 12-18 months, when the housing market will hopefully catch up with the demand and prices will stabilize. The second driver of apartment rates is the shift towards units closer to downtown. A shift in construction toward downtown, the medical center and the east side of Houston is already being seen. Increasingly, Houstonians want to live closer to work and are willing to pay premiums to do so. This shift toward a closer commute is also spawning the numerous mixed-use developments around town.

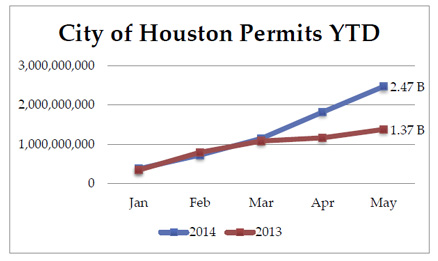

City of Houston permits, a lagging indicator of the amount of construction activity in Houston, has been breaking records, with current year to date (through May) numbers of $2.47 Billion in non-residential work alone. The southern region of the Architecture Billings Index, a leading indicator, is way up, supporting the strong market we are experiencing locally.

Houston’s Monthly Metrics: July

by Candace Hernandez | July 08, 2014

Add new comment