The following article originally appeared in the May newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

The following article originally appeared in the May newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

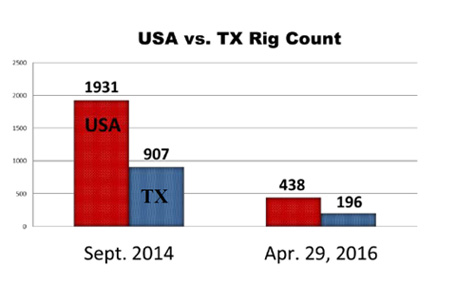

When asked how much further the rig count will drop, the running joke is that we think it won’t go negative. Now at over a 75% decline, both nationally and in Texas, from September 2014 (pictured right) the current rig count reflects the complete reversal of the oil and gas industry dynamics from less than two years ago.

Dr. Bill Gilmer, Director of the Institute for Regional Forecasting, noted that in the last seven quarters, Houston has been hit much harder and faster, when compared to the five years in the 1980’s (1982-1986) when oil last saw a comparable downturn. The difference? Saudi Arabia’s behavior.

No longer willing to be the cyclical producer, Saudi Arabia has flexed their muscle and forced the US to taken on that role going forward. For the US, that means bigger swings in the future as we ebb to Saudi’s flow. And if Prince al-Naimi is true to his threat at Doha, even more production will be coming out of Saudi Arabia soon, continuing to depress the price of oil as supply outpaces demand.

For Houston, the timing is bad. As the booming petrochemical construction winds down in 2017, economists hoped that oil would have recovered and those workers would have opportunities in oil and gas. If we don’t see oil prices tick up in the next two quarters 2017 begins to look bleak.

CBRE’s recent data show sublease space has now spilled over into the light industrial market, Metrostudy is reporting a 10.5% decline in housing starts and the Q1 employment numbers are weak. After analyzing the year-end employment data, Patrick Jankowski, Greater Houston Partnership, noted that the largest job losses in Houston were in high-paying basic employment jobs (oil and gas, manufacturing, etc.) and the biggest job gainers were in non-basic employment (schools, grocery, restaurants, medical) which are much lower paying, and not likely to do as well going forward, given the weak numbers in the first quarter of 2016. Increasingly, economists are shifting to a potentially negative year of job growth for Houston in 2016.

Houston’s Monthly Metrics: May 2016

by Candace Hernandez | May 09, 2016