The following article originally appeared in the October newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

The following article originally appeared in the October newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

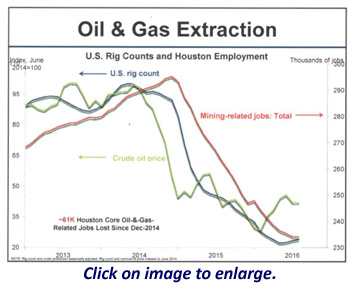

Did Houston already go into a recession? Jesse Thompson, Business Economist at the Federal Reserve Bank of Dallas - Houston Branch, noted the Houston Business Cycle Index shows that Houston entered a recession late 2015/early 2016. He provided a chart (right) showing the correlation between rig count and Houston’s core oil and gas related employment noting “further revisions will like confirm what we’ve already observed: that Houston’s economy is contracting, and that Houston may or may not be out of it yet.”

However, fueling the recovery discussion is the renewed optimism in the Purchasing Managers Index’s oil and gas respondents, who for the first time in several months, seemed happier and more upbeat. The PMI itself increased to 46.1 in August – still in an overall contraction phase, but production, sales and new orders were all noticeably up, a leading indicator. Vehicle sales had their highest month in August, and remain only slightly behind the record pace of 2015. Metrostudy is still expecting a respectable 24,500 housing starts by year-end CBRE reports positive absorption in industrial and a retail market so strong that it should exceed 2015’s absorption numbers.

So are these recent upticks proof of a recovery? Whether the recent uptick in rig count is a sign of a true recovery, or just a false start, remains to be seen. If it is the former, then Dr. Bill Gilmer, Director of the Institute for Regional Forecasting, feels that Houston’s horizon may be much rosier than previously projected. But even if the recovery has begun, all agree that it is expected to be a long, slow recovery for Houstonians, with 2017 relatively flat, unless there is an anomalous event that catapults the economy back into full swing. For the commercial construction market, who tends to lag the Houston economy by about 18-24 months, we are only now entering the slowdown and likely will have a slower year ahead of us.

Houston’s Monthly Metrics: October 2016

by Candace Hernandez | October 13, 2016