According to a report released last fall by the Money Service Business Facilitated-Workers’ Compensation Fraud Work Group in the State of Florida, “Workers’ compensation fraud is a serious problem.” Not just in Florida, but in any state where there are folks working for cash in the underground economy and where there are check cashing services willing to play the insurance premium fraud game. According to the report,

According to a report released last fall by the Money Service Business Facilitated-Workers’ Compensation Fraud Work Group in the State of Florida, “Workers’ compensation fraud is a serious problem.” Not just in Florida, but in any state where there are folks working for cash in the underground economy and where there are check cashing services willing to play the insurance premium fraud game. According to the report,

“This type of fraud is most prevalent in the construction industry where a high percentage of the labor force is transient. The costs to the system for this type of fraud include unreported payroll taxes, unreported premium taxes, and higher costs to insurance carriers who must process workers’ compensation claims for uninsured workers. It is estimated that the costs of this type of fraud could cost the state upwards of $1 billion annually, and places tremendous pressure on law-abiding businesses to absorb the costs of premium avoidance.”

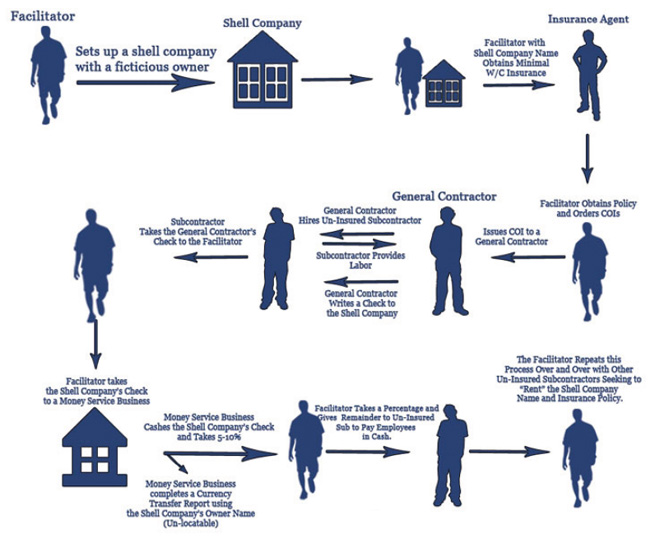

Here, according to the report, is the way it works. The individuals who create this scheme, a new twist on older schemes, are “facilitators” who create fake or shell companies and who have no real business operations, no labor force and only a post office box for a location. (Remember Carole Johnson Builders LLC?) After the “company” is set up under state laws, the owner finds an insurance agency who may or may not be in on the scheme. Through that agency, the owner of the fictitious company fills out an application for a small, “low-risk trade, such as drywall installation, brick paver installation, or carpentry work.” The agent then underwrites the policy and issues it to the post office box. The initial payment is minimal and the scheme is set up and ready to unfold. The “facilitator” will market his shell to uninsured contractors who are unwilling or unable to get the workers’ comp policy to cover their workers who are actually employees even though they are often misclassified as independent contractors. Essentially these subs are renting the workers’ comp certificates and then are using undocumented workers.

The “facilitator” will market his shell to uninsured contractors who are unwilling or unable to get the workers’ comp policy to cover their workers who are actually employees even though they are often misclassified as independent contractors. Essentially these subs are renting the workers’ comp certificates and then are using undocumented workers.

By engaging in the game they are able to seriously underbid legitimate subcontractors who are paying all of the burden on their employees. Payment to the uninsured and often undocumented subcontractors is usually made to the shell company. Since they cannot cash those checks at a legitimate bank, (the banks require that they are deposited into an account either directly or digitally), they are taken to a “money service / check cashing” business where there are agreements to cash the checks for fees. Usually there are two fees taken out of the check – 2% to cash the check and 6 to 8% for the facilitator as a fee for the use of the fake company name and for the insurance certificates. The remainder of the cash is then distributed by the sub to his workers who seldom complain because of their status in the country.

According to the findings of the report, “facilitators” can use the scheme over and over – perhaps hundreds of times. In one case, the investigators found that one facilitator cashed $27 million in checks, each worth over $10,000, in a four-year period.

By approaching the business in this manner, the subs and their facilitators avoid paying all types of taxes. They pay around 10% of payroll and avoid the other 20% of burden that a legitimate company would pay. That, in turn, allows them to underbid the legitimate companies who are their competitors and to perpetuate the scheme and defraud the state and the fed of billions of dollars.

We will bring more of this type information to you so that you will better understand how you, the community, the state and federal government, and the industry are being cheated everyday by illicit operators.

Insurance Premium Fraud in the Construction Industry: What to Look For

by Jim Kollaer | May 10, 2012

Add new comment