The presidential election of November 2016 represents an historic change in the United States, producing a new President-elect, Donald J. Trump, who has proposed policies to “Make America Great Again.” Those policies include controlling immigration, renegotiating trade agreements, raising defense spending (of the U.S. and its allies), cutting personal and corporate tax rates, increasing energy independence, reducing regulation, and spending up to $1 Trillion to rebuild U.S. infrastructure. All or any combination of these, could potentially have a powerful impact on our future.

The presidential election of November 2016 represents an historic change in the United States, producing a new President-elect, Donald J. Trump, who has proposed policies to “Make America Great Again.” Those policies include controlling immigration, renegotiating trade agreements, raising defense spending (of the U.S. and its allies), cutting personal and corporate tax rates, increasing energy independence, reducing regulation, and spending up to $1 Trillion to rebuild U.S. infrastructure. All or any combination of these, could potentially have a powerful impact on our future.

A review of the construction outlook for chemical plants, LNG terminals, gas plants, refineries, and transmission and distribution for oil and gas leads us to believe, despite abundant uncertainty, that the proposals of President-elect Trump improve the prospects for industrial construction almost across the board.

Regulatory changes will encourage the production of natural gas – encouraging investment in chemical plants, natural gas liquefaction facilities, refineries, and natural gas plants – even though increased capital costs, due to higher interest rates, will somewhat reduce those investments. The outlook for pipelines is better, since the Trump Administration will promote the Keystone North project and encourage the production and utilization of domestic oil and natural gas. [node:read-more:link]

The presidential election of November 2016 represents an historic change in the United States, producing a new President-elect, Donald J. Trump, who has proposed policies to “Make America Great Again.” Those policies include controlling immigration, renegotiating trade agreements, raising defense spending (of the U.S. and its allies), cutting personal and corporate tax rates, increasing energy independence, reducing regulation, and spending up to $1 Trillion to rebuild U.S. infrastructure. All or any combination of these, could potentially have a powerful impact on our future.

The presidential election of November 2016 represents an historic change in the United States, producing a new President-elect, Donald J. Trump, who has proposed policies to “Make America Great Again.” Those policies include controlling immigration, renegotiating trade agreements, raising defense spending (of the U.S. and its allies), cutting personal and corporate tax rates, increasing energy independence, reducing regulation, and spending up to $1 Trillion to rebuild U.S. infrastructure. All or any combination of these, could potentially have a powerful impact on our future.

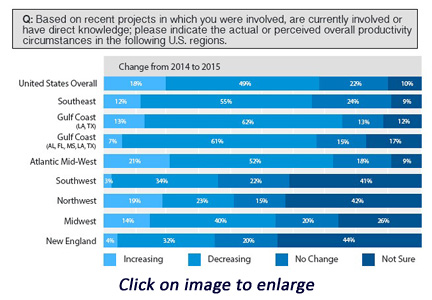

Craft labor shortages are a serious issue with an enormous impact on project productivity. To gain a better understanding of productivity from their perspective, the

Craft labor shortages are a serious issue with an enormous impact on project productivity. To gain a better understanding of productivity from their perspective, the  Craft shortages continue to be a boon for experienced workers who are commanding top pay for their high-demand skills. On the other hand, rising wages in a shortage environment tend to benefit unskilled workers also, and employers are too often paying premium wages for insufficient training and lower productivity. Why? Because bodies are needed and employers must compete for every craft worker.

Craft shortages continue to be a boon for experienced workers who are commanding top pay for their high-demand skills. On the other hand, rising wages in a shortage environment tend to benefit unskilled workers also, and employers are too often paying premium wages for insufficient training and lower productivity. Why? Because bodies are needed and employers must compete for every craft worker. On May 29, 2014, I had the opportunity to be on the Louisiana Business and Industry Show to discuss the skilled labor market challenges and the tools available to more effectively plan project labor and manage project labor risk.

On May 29, 2014, I had the opportunity to be on the Louisiana Business and Industry Show to discuss the skilled labor market challenges and the tools available to more effectively plan project labor and manage project labor risk. The construction industry is facing a perfect storm of issues, which will result in severe skilled workforce shortages in the near future. The

The construction industry is facing a perfect storm of issues, which will result in severe skilled workforce shortages in the near future. The  Real improvement requires actionable data. Measures are used to establish realistic goals and to track progress, and there are many examples in the construction industry. Safety improvement is based on measures of recordable and lost time accidents. Cost management uses budgets and spending reports. Quality improvement is based on regular reports on trends of defects to identify problem areas.

Real improvement requires actionable data. Measures are used to establish realistic goals and to track progress, and there are many examples in the construction industry. Safety improvement is based on measures of recordable and lost time accidents. Cost management uses budgets and spending reports. Quality improvement is based on regular reports on trends of defects to identify problem areas.