Aging tunnels in America, coupled with the country’s continued growth, have created an extremely high demand for attention. The imminent repair and replacement will result in...

Signals and Signposts

The current and future economy, trends in design and construction, political influence – sometimes we have something to say about topics which may be signs of things to come.

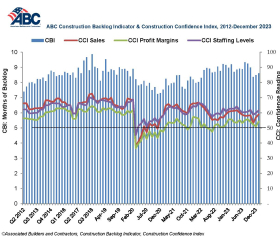

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.6 months in December from 8.5 months in November, according to an ABC...

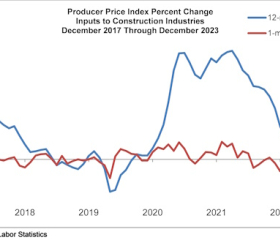

Construction input prices decreased 0.6% in December compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor...

Authored by Mary Scott NabersIn past years, it was likely more difficult for companies to categorize renovation and repair projects as highly attractive. That may not be the...

Contractors are generally optimistic about the outlook for nonresidential and multifamily construction in 2024, but optimism is less widespread than a year ago, based on the 2024...

Seasonally adjusted construction employment rose from November 2022 to November 2023 in 34 states and the District of Columbia, fell in 14 states, and held steady in Alaska and...

Input prices and bid prices for construction were little changed in November from October or year-over-year (y/y) from November 2022, according to data the Bureau of Labor...

For the first time, Georgia was named the top state for construction in Associated Builders and Contractors’ annual Merit Shop Scorecard. The scorecard, released yearly...

Construction employment, seasonally adjusted, totaled 8,033,000 in November, a gain of 2,000 from October and 200,000 (2.6%) year-over-year (y/y), according to AGC’s analysis...