National nonresidential construction spending increased 0.1% in October, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census...

Signals and Signposts

The current and future economy, trends in design and construction, political influence – sometimes we have something to say about topics which may be signs of things to come.

Construction spending (not adjusted for inflation) totaled $2.027 trillion in October at a seasonally adjusted annual rate, up 0.6% from the upwardly revised September rate and up...

Seasonally adjusted construction employment rose from October 2022 to October 2023 in 40 states and the District of Columbia, fell in eight states, and held steady in Connecticut...

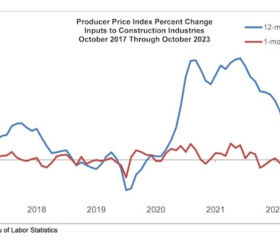

Construction input prices declined 1.2% in October on a monthly basis, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer...

The Dodge Momentum Index increased 1% in October from September but slumped 8% year-over-year (y/y), Dodge Construction Network reported on Tuesday. The index is “a...

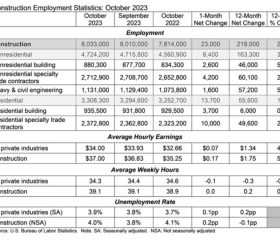

The construction industry added 23,000 jobs on net in October, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor...

Construction employment, seasonally adjusted, totaled 8,033,000 in October, a gain of 23,000 from September and 219,000 (2.8%) year-over-year (y/y), according to AGC’s ...

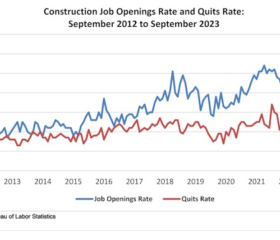

The construction industry had 431,000 job openings on the last day of September, according to an Associated Builders and Contractors analysis of data from the U.S. Bureau of Labor...

The hotel construction market appears to be doing well. “The total U.S. construction pipeline stands at 5,704 projects/672,676 rooms, up 7% year-over-year (y/y) by projects and...