Worker Misclassification

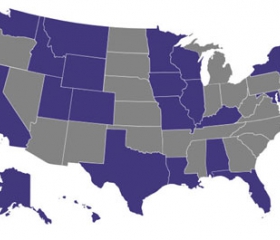

Payroll fraud (also called worker misclassification and workplace fraud) is the illegal practice of designating an employee as a "1099 worker" or an independent contractor. Unscrupulous employers do this to avoid paying payroll taxes, unemployment tax, or workers’ compensation insurance and are therefore able to submit lower bids for projects, undercutting responsible contractors. Several states have already passed laws to penalize those who cheat workers and taxing agencies in this way.