Seasonally adjusted construction employment rose from September 2022 to September 2023 in 43 states and the District of Columbia and declined in seven states, according to AGC’s...

Signals and Signposts

The current and future economy, trends in design and construction, political influence – sometimes we have something to say about topics which may be signs of things to come.

Input prices and bid prices for construction were little changed from August to September, according to data the Bureau of Labor Statistics posted on Wednesday. The...

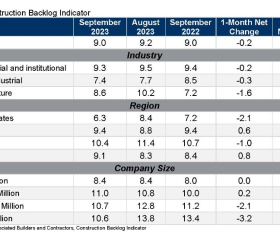

Associated Builders and Contractors reported Tuesday that its Construction Backlog Indicator declined to 9.0 months in September, according to an ABC member survey conducted Sept...

Construction employment, seasonally adjusted, totaled 8,014,000 in September, a gain of 11,000 from August and 217,000 (2.8%) year-over-year (y/y), according to AGC’s ...

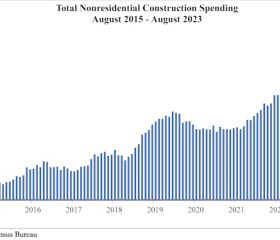

National nonresidential construction spending increased 0.4% in August, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census...

Construction employment, not seasonally adjusted, rose from August 2022 in 223 (62%) of the 358 metro areas (including divisions of larger metros) for which BLS posts ...

Seasonally adjusted construction employment rose from August 2022 to August 2023 in 45 states and the District of Columbia and declined in five states, according to AGC’s ...

The producer price index (PPI) for material and service inputs to new nonresidential construction rose 1.1%, not seasonally adjusted, from July to August, propelled by a 34.6%...

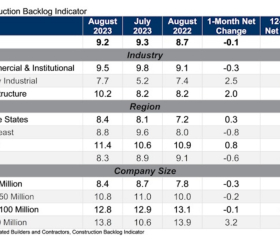

Associated Builders and Contractors reported Sptemeber 12 that its Construction Backlog Indicator declined to 9.2 months in August, down 0.1 month, according to an ABC...