Seasonally adjusted construction employment rose year-over-year (y/y) from March 2023 to March 2024 in 39 states, fell in 10 states and the District of Columbia, and was unchanged...

Signals and Signposts

The current and future economy, trends in design and construction, political influence – sometimes we have something to say about topics which may be signs of things to come.

Bid prices and input prices for construction showed mixed monthly and year-over-year (y/y) patterns in March, according to data the Bureau of Labor Statistics (BLS) posted...

Construction employment, seasonally adjusted, totaled 8,211,000 in March, a gain of 39,000 from February and 270,000 (3.4%) year-over-year (y/y), according to AGC’s analysis...

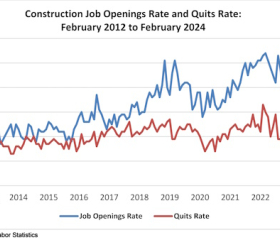

The construction industry had 441,000 job openings on the last day of February, according to an Associated Builders and Contractors analysis of data from the U.S. Bureau of Labor...

The tragic Francis Scott Key Bridge collapse in Baltimore will have multiple, but as yet uncertain, implications for construction. Bloomberg reported on Tuesday, “...

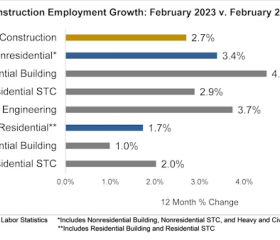

Seasonally adjusted construction employment rose from February 2023 to February 2024 in 39 states and fell in 11 states and the District of Columbia, according to AGC’s ...

Here’s a fact that may be surprising – it surely was to me. The construction or renovation of buildings accounts for approximately 39% of the total global energy-related carbon...

Bid prices and input prices for construction showed mixed monthly and year-over-year (y/y) patterns in February, according to data the Bureau of Labor Statistics (BLS) posted...

WASHINGTON, March 8—The construction industry added 23,000 jobs on net in February, according to an Associated Builders and Contractors analysis of data released today by the...